About the Fund

Triskel Wallet Fund is an equity fund centred on the Triskel Wallet, a pioneering force in the crypto banking sector. With a focused investment approach, the fund aims to deliver up to 50% annual returns, driven by market expertise and a robust strategy.

Key Features

Exclusive Investment Focus

The fund is solely dedicated to Triskel Wallet, capitalizing on its industry-leading position in crypto banking.

Low Liquidity, High Potential

While liquidity is limited in the early stages, a secondary market is expected by the third year, enhancing exit opportunities.

Exceptional Returns

Strategic Exit Options

Potential exits include dividends, participation in a secondary market, or an eventual company sell-out.

Defined Investment Horizon

Designed for long-term growth with a commitment of 3-5 years.

Meet Our Team

Triskel Wallet Fund is managed by a team of seasoned professionals with a proven track record.

Abel Benítez

Founding Partner

A visionary leader with deep expertise in alternative investments.

Arturo Chayet

Managing Partner

A strategist with extensive experience in managing high-value portfolios.

Illiane Caballero

Operating Partner

A dynamic operator known for executing complex investment strategies seamlessly.

Investment Details

Private Placement Memorandum (PPM)

The fund’s comprehensive PPM outlines every detail of the investment opportunity, ensuring transparency and compliance.

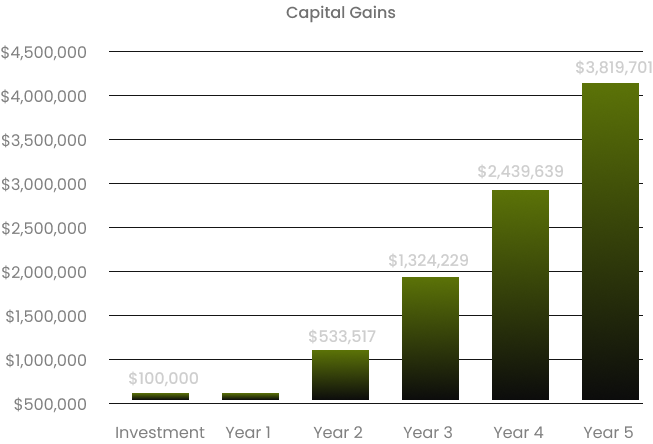

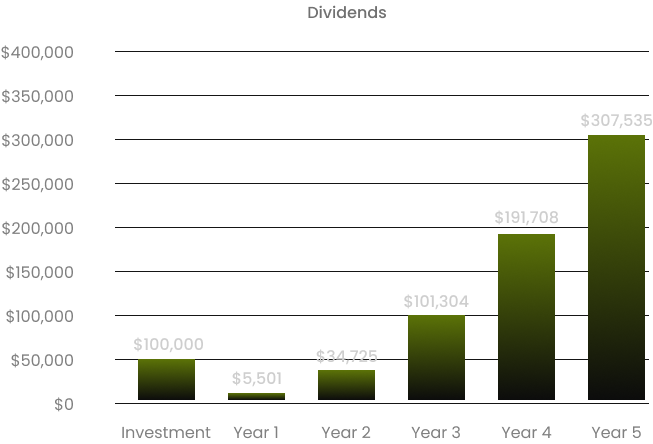

Investment Calculator

Visualize your potential returns and dividends with our intuitive calculator. For instance, a $100,000 investment could generate substantial capital gains and dividends over five years.

Frequently Asked Questions

1. What is the primary asset of Triskel Wallet Fund?

2. What kind of returns can I expect?

3. What is the risk and liquidity profile?

4. Is the Triskel Wallet Fund right for me?

5. How can I track my investment?

Glossary of Terms

To help investors navigate the investment process, we have included an overview of the essential terms

Accredited Investor

An individual or entity that meets specific financial criteria set by regulatory authorities, allowing them to invest in private offerings.

Alternative Investment

Investments that do not fall into traditional asset classes, such as stocks or bonds. This may include private equity, hedge funds, real estate, and commodities.

Capital Call

Fund manager places this request to the investors for a share of their capital committed for investments.

Capital Commitment

The total amount of capital that an investor agrees to invest in the fund.

Carried Interest

The share of profits that the general partner receives from the fund’s gains, usually after returning capital to limited partners.

Confidentiality Agreement

A legal document that outlines the confidentiality obligations of parties involved in the investment process.

Due Diligence

The investigation and analysis conducted prior to making investment decisions, assessing the potential risks and value of an investment.

Distributions

Payments made to investors from the profits or returns generated by the fund.

Equity

Ownership interest in a company, typically represented by shares.

Exit Strategy

The plan for how the fund will realize returns on its investments, such as through sales or public offerings

Fee Structure

The outline of the fees charged to investors, which may include management fees and performance fees.

General Partner (GP)

The entity or individual responsible for managing the fund and making investment decisions.

Investment Objective

The specific goals and strategy that guide the fund’s investments.

Investment Strategy

The approach and techniques employed by the fund to achieve its investment objectives.

Limited Partner (LP)

An investor who provides capital to the fund but has limited control over its management.

Liquidity

The ease with which an investment can be converted into cash without significantly affecting its value.

Management Fee

A fee paid to the general partner for managing the fund, usually calculated as a percentage of committed or invested capital.

Net Asset Value (NAV)

The value of the fund’s assets minus its liabilities, often used to determine the value of an investment.

Performance Fee

A fee based on the fund’s profits, typically calculated as a percentage of returns above a certain benchmark.

Placement Agent

An intermediary that assists in raising capital for the fund by marketing it to potential investors.

Private Placement Memorandum (PPM)

A legal document that provides detailed information about the investment fund and its offering.

Private Equity

Equity investments made directly in private companies or buyouts of public companies.

Redemption

The process by which an investor withdraws their investment from a fund.

Risk Factors

Disclosures in the PPM outlining the potential risks involved in investing in the fund.

Securities Regulation

The body of laws and regulations governing the offering and sale of investment securities.

Subordination

The positioning of a debt in relation to other debts in terms of claim on assets or earnings.

Term Sheet

A non-binding agreement outlining the key terms and conditions of an investment.

Total Return

The overall return on an investment, including both income and capital appreciation.

Alternative Investment

Investments that do not fall into traditional asset classes, such as stocks or bonds. This may include private equity, hedge funds, real estate, and commodities.

Capital Call

Fund manager places this request to the investors for a share of their capital committed for investments.

Accredited Investor

An individual or entity that meets specific financial criteria set by regulatory authorities, allowing them to invest in private offerings.

Valuation

The process of assessing the value of an investment or asset.

Venture Capital

A type of private equity investment focused on startups and early-stage companies with high growth potential.

Investment Committee

A group of individuals within the fund responsible for making investment decisions.

Lock-up Period

A specified time during which investors are prohibited from redeeming their interests in the fund.

Commitment Period

The duration during which the fund can make investments using the committed capital.

Covenants

Conditions or clauses in a debt agreement that impose certain obligations on the borrower.

Market Capitalization

The total market value of a company’s outstanding shares, often used to gauge a company’s size.

Direct Investment

An investment made directly into a company or asset rather than through a fund.

Secondary Market

A marketplace for investors to trade financial items that have already been issued.

Preferred Equity

A type of equity that provides holders with preferential treatment in terms of dividends or returns.

Common Equity

The most basic form of ownership in a company, typically represented by common stock.

Investment Thesis

A statement or rationale that outlines the expected benefits and reasoning behind investing in a particular asset or fund.

Advisory Board

A group of experts who provide guidance and advice to the fund’s management team.

Sponsor

A term often used interchangeably with general partner, referring to the entity managing the fund.

Carried Interest Waterfall

The structure determining how profits are distributed among limited and general partners, including hurdles and catch-up clauses.

Hurdle Rate

The minimum return that must be achieved before the general partner is entitled to receive carried interest.

Follow-On Investment

Additional investments made in a portfolio company after the initial investment.

Incubator

A type of investment fund that provides support and capital for early-stage startups.

Exit Multiple

A valuation metric used to determine the value of an investment at the time of exit, typically measured as a multiple of earnings or revenue.

Asset Class

A group of securities that exhibit similar characteristics and behave similarly in the marketplace, such as equities, fixed income, or real estate.

Diversification

The strategy of spreading investments across various assets to reduce risk.

Yield

The income generated from an investment, often expressed as a percentage of the investment’s value.

Investor Testimonials

Our investors are thrilled with the transparency, strategy, and potential offered by Triskel Wallet Fund.

(Testimonials coming soon!)

Begin your journey with Triskel Wallet Fund today! Our team will guide you through the entire process and resolve all your queries.